When it comes to luxury watches, the idea of combining style and investment is a tempting one. Tudor, the sister brand to the famous Rolex, has been steadily gaining attention as a brand that offers both craftsmanship and value. But can a Tudor watch actually serve as a good investment? In this blog, we’ll dive into the factors that affect the investment potential of Tudor watches, from their brand reputation and historical performance to market trends and future outlook. We will also explore the question: do Tudor watches hold value?

A Brief Overview of Tudor

Before we get into whether Tudor watches are a sound investment, it’s essential to understand what makes the brand stand out.

The Rolex Connection

Tudor was founded in 1926 by Hans Wilsdorf, the same visionary who created Rolex. His mission for Tudor was clear: to offer a more affordable alternative to Rolex while maintaining the same high standards of quality. Tudor watches are designed and assembled with the same attention to detail, but they feature less expensive materials and movements compared to their Rolex counterparts.

This strong association with Rolex has always been a major selling point for Tudor. You’re essentially getting a piece of Rolex heritage without the sky-high price tag. Over the years, Tudor has carved out its own niche in the watch market, evolving from a brand that Rolex often overshadowed into one with a devoted following of its own.

Tudor’s Popular Models

Some of Tudor’s most popular models include:

- Tudor Black Bay: Known for its vintage diving watch aesthetic, the Black Bay is arguably the brand’s flagship model. The Black Bay models showcase impressive craftsmanship and style, featuring in-house calibres and design elements inspired by vintage dive watches, making them appealing to both enthusiasts and collectors. The Tudor Black Bay GMT, with its matte black dial and striking blue and red aluminium bezel, stands out for its distinctive features and value retention in the second-hand market.

- Tudor Pelagos: A professional-grade dive watch, the Pelagos boasts titanium construction and water resistance up to 500 meters, making it a robust choice for divers.

- Tudor Heritage Chrono: A nod to Tudor’s 1970s chronographs, the Heritage Chrono brings a sporty and vintage feel to the modern wrist.

These models, and many others, have played a key role in Tudor’s rise in popularity, and they are central to the discussion of whether Tudor watches make for good investments.

What Makes a Watch a Good Investment?

Before we answer the question of whether Tudor watches are a good investment, let’s define what makes any watch a smart investment. Luxury watches are often viewed as a safe haven for value, especially during times of economic uncertainty. But not all watches appreciate in value. Several factors come into play when determining if a watch is a good investment:

1. Brand Reputation

The reputation of the brand behind a watch is crucial. Brands like Rolex, Patek Philippe, and Audemars Piguet have consistently maintained high demand, which drives up their value on the secondary market. While Tudor may not have the same prestige, its association with Rolex certainly adds credibility.

2. Rarity

Limited editions and rare models tend to appreciate the most in value. A rare Tudor watch, for instance, can see its value significantly enhanced due to its scarcity. If a watch is produced in low numbers or has a unique design, collectors are more likely to seek it out, driving up its price.

3. Condition

A well-maintained, unworn, or minimally worn watch is far more likely to retain or increase in value compared to one that has seen heavy use. Original packaging, warranty cards, and service records also contribute to a watch’s resale value.

4. Historical Significance

Watches that have a notable history or connection to iconic moments or individuals tend to have higher resale values. The vintage appeal of certain models, or watches worn by celebrities, can drive their price up considerably.

5. Market Trends

The luxury watch market can fluctuate, and while some brands and models are known for consistent value appreciation, market trends and consumer preferences can shift over time. Keeping an eye on these trends is essential for any watch investor.

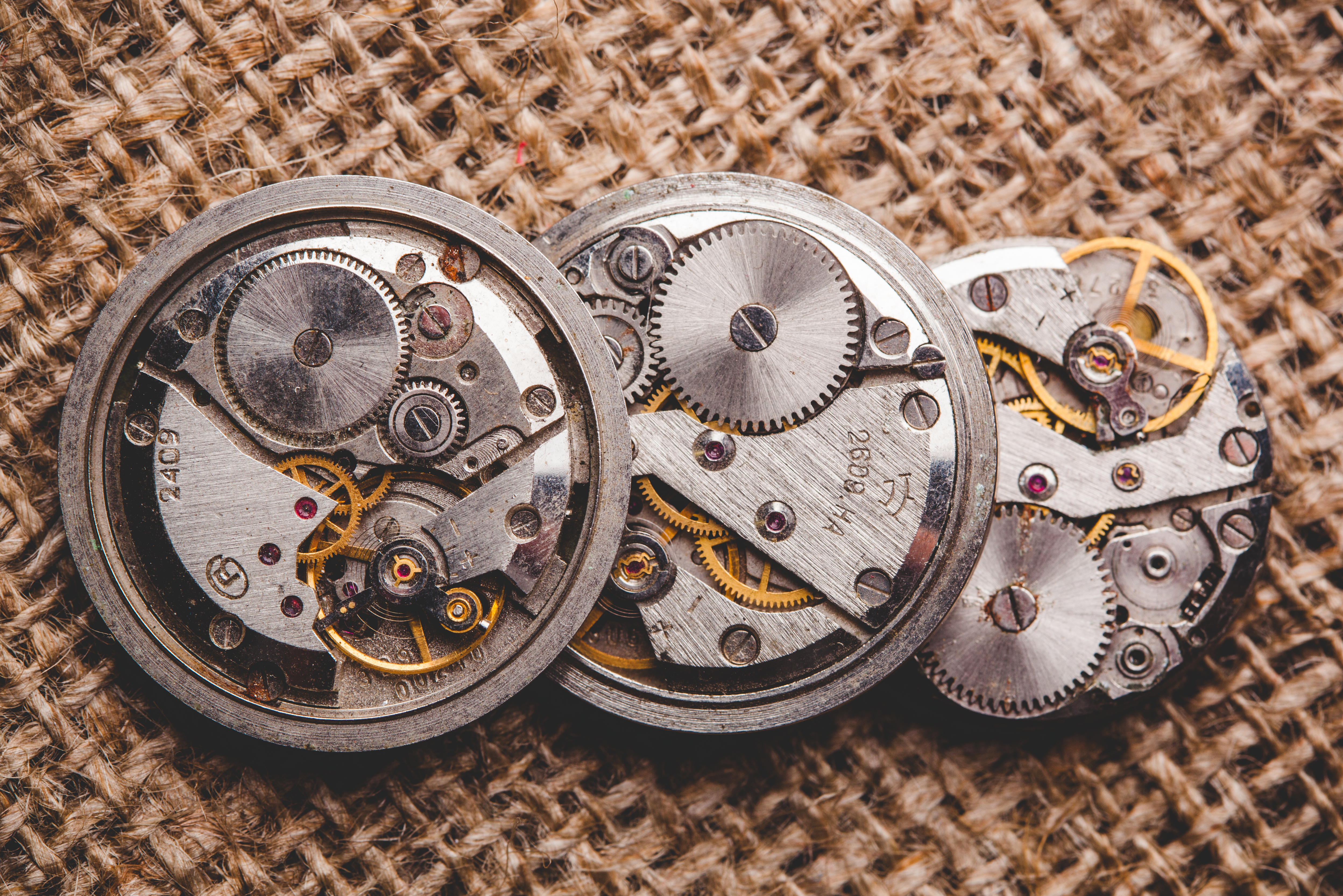

6. Craftsmanship and Technology

Watches that feature advanced craftsmanship, innovation, and unique movements are often seen as valuable assets. Watch enthusiasts are willing to pay more for timepieces that demonstrate exceptional technical complexity.

How Do Tudor Watches Measure Up as an Investment?

Now that we’ve outlined the factors that influence a watch’s investment potential, let’s see how Tudor watches stack up.

1. Brand Reputation: A Strong Heritage

Tudor may not have the same level of prestige as Rolex, but the Tudor brand still enjoys a solid reputation within the watch community. Over the past decade, Tudor has made a name for itself as a brand that combines vintage-inspired designs with modern technology, and this has resonated with collectors and enthusiasts.

One of Tudor’s key advantages is its association with Rolex. This relationship lends the brand a level of credibility and recognition that many other watchmakers don’t have. Tudor watches are seen as a more accessible entry point into the world of Swiss luxury watches, while still offering top-tier quality.

However, Tudor doesn’t hold the same level of market power as Rolex. Rolex watches are known for consistently appreciating in value, whereas Tudor watches may not see the same level of growth. Still, for those who appreciate the heritage and craftsmanship of Tudor, it offers a compelling balance of quality and affordability.

2. Rarity: Limited Editions and Collectible Models

Tudor has been strategic in releasing limited edition models, which often attract collectors. Not all Tudor watches are equal in terms of value retention and desirability. For example, the Tudor Black Bay Fifty-Eight Navy Blue, introduced in 2020, has become a sought-after model. Limited-edition pieces often come with unique designs or features that set them apart from regular production models, making them more likely to appreciate over time.

However, while some Tudor models are rarer than others, the brand is not known for producing ultra-limited editions in the same way that brands like Patek Philippe or Audemars Piguet do. This limits the potential for certain Tudor models to skyrocket in value based purely on rarity.

3. Condition: High Durability and Long-Term Value

Tudor watches are built to last. Their rugged construction and use of quality materials, like stainless steel and ceramic, ensure that they can stand the test of time. Models like the Black Bay and Pelagos are known for their durability and water resistance, making them perfect for both everyday wear and more adventurous pursuits.

The fact that Tudor watches are designed to be worn and used means that they can retain their value if kept in good condition. Watches that are well-maintained, with minimal wear and tear, are more likely to appreciate in value. Keeping the original packaging and documentation is also essential for maximising resale value.

4. Historical Significance: A Brand with a Rich Past

Tudor’s history, particularly its connection to Rolex and its use by professional divers in the mid-20th century, gives it a strong heritage. The increasing demand for vintage Tudor watches, including models like the Submariner and Tiger, highlights their investment potential. Additionally, vintage watches hold significant value in the luxury watch market, especially Tudor models that have appreciated over time. The brand’s vintage models, like the Tudor Submariner, have become highly collectable and often fetch high prices on the secondary market. These older models, which carry historical significance, are likely to continue appreciating in value.

Tudor’s modern collections also pay homage to this rich history, particularly with its Heritage line. By blending vintage aesthetics with modern craftsmanship, Tudor has managed to create timepieces that appeal to both history buffs and modern watch enthusiasts.

5. Market Trends: The Rise of Tudor

In recent years, Tudor has seen a resurgence in popularity. Tudor’s Black Bay collection has significantly contributed to this rise, showcasing vintage design elements that resonate with many. Black Bay watches, with their retro-inspired sports designs and impressive technical specifications, appeal to both traditional and modern watch enthusiasts. The brand’s re-launch in 2010 with the Heritage Chrono marked the beginning of a new era for Tudor. The introduction of the Black Bay collection, with its vintage dive watch appeal, solidified Tudor’s place as a brand to watch.

As of now, Tudor watches are considered highly desirable by collectors and enthusiasts, thanks to their balance of affordability, style, and quality. The brand’s growing popularity has led to increased demand for certain models, which has, in turn, driven up resale prices for those pieces. While Tudor may not experience the same explosive growth in value as Rolex, it has proven to be a solid contender in the luxury watch market.

6. Craftsmanship and Technology: A Strong Offering

Tudor watches hold a unique position in the luxury watch market, benefiting from Rolex’s advanced watchmaking expertise, which ensures that each piece is built to the highest standards. The introduction of in-house movements in recent years has further boosted the brand’s reputation for innovation and craftsmanship. In-house movements, as opposed to outsourced movements, tend to add value to watches because they showcase the brand’s technical expertise.

For example, the Tudor Pelagos and Black Bay Fifty-Eight are equipped with Tudor’s in-house calibres, which offer excellent performance and precision. These watches demonstrate the brand’s commitment to quality and innovation, making them attractive to collectors and enthusiasts.

Potential Risks of Investing in Tudor Watches

As with any investment, there are risks involved in investing in Tudor watches. The watch industry significantly impacts the value of luxury watches, with factors like brand status, material quality, and technological innovation playing crucial roles. The watch brand is also essential in determining a watch’s investment potential, as well-known brands like Tudor, Rolex, Patek Philippe, and Audemars Piguet are more likely to retain their economic worth.

- Market Volatility: The luxury watch market can be unpredictable. While Tudor is experiencing a surge in popularity now, trends could change, potentially affecting the resale value of certain models.

- Slower Appreciation: Tudor watches generally don’t appreciate in value as quickly or as dramatically as Rolex or Patek Philippe. While some models may increase in value, the growth may be slower compared to other brands.

- Mass Production: Unlike ultra-rare timepieces, many Tudor models are produced in larger quantities. This reduces their scarcity, which in turn can limit their potential for significant appreciation.

So, are Tudor watches a good investment? The answer depends on what you’re looking for. If you’re seeking a watch that will provide quick returns or rapid appreciation, Tudor might not be the best choice. Brands like Rolex, Patek Philippe, or Audemars Piguet are more likely to deliver those kinds of returns due to their exclusivity and market demand.

However, if you’re interested in owning a high-quality luxury watch with a rich history and strong craftsmanship, Tudor is an excellent choice. Its growing reputation, connection to Rolex, and commitment to innovation make it a brand that could appreciate over time, especially with limited-edition models or those in excellent condition.

For those who appreciate style and substance—and don’t mind a longer investment horizon—Tudor watches offer a rewarding experience both as a timepiece and a potential investment.